From the towering peaks of Mount Fuji to the bustling cityscape of Tokyo, Japan is home to some of the world’s biggest pharmaceutical powers. Just what has led to Japan being known as such a hotspot for pharma, and what are its focuses for future progression?

Words by Jade Williams

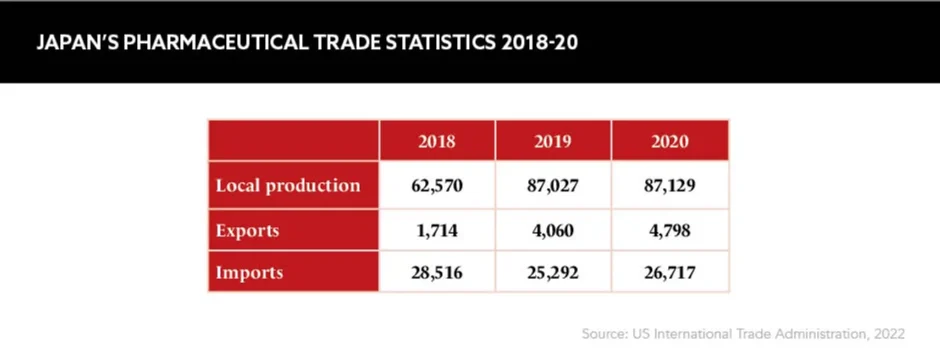

Japan is a nation of innovation with a lengthy history of scientific research. The country is the third largest pharma destination in the world, accounting for 7% of the global market share, and the region has contributed to the development of some of healthcare’s standout successes.

“Japan is famous for its extra-long lifespan, ikigai [a sense of purpose and reason for living] and blue zones which promote long term wellbeing and active ageing,” says Jennifer Cain Birkmose, Co-founder and Chief Executive, Viva Valet, Elder Support Digital Platform, and Senior Principal, Management Consultant, IQVIA. “The healthcare system is marked by universal access to healthcare, which drives health equity.”

In 2015, Japan established the Agency for Medical Research and Development with the goal of fast-tracking medical R&D that directly benefits people, not only by extending lifespans, but also by improving quality of life. This is something that the country’s ageing population has greatly benefitted from.

The healthcare system is marked by universal access to healthcare, which drives health equity

Free access to healthcare is another perk enjoyed by Japan’s population. “Almost the entire population of 126 million people are covered under this framework,” states Bartosz Lukowski, Immunology Medical Head, UCB Japan. In fact, patients in Japan have access to some of the best care and treatments in the world, with the nation focusing on preventative rather than reactive healthcare.

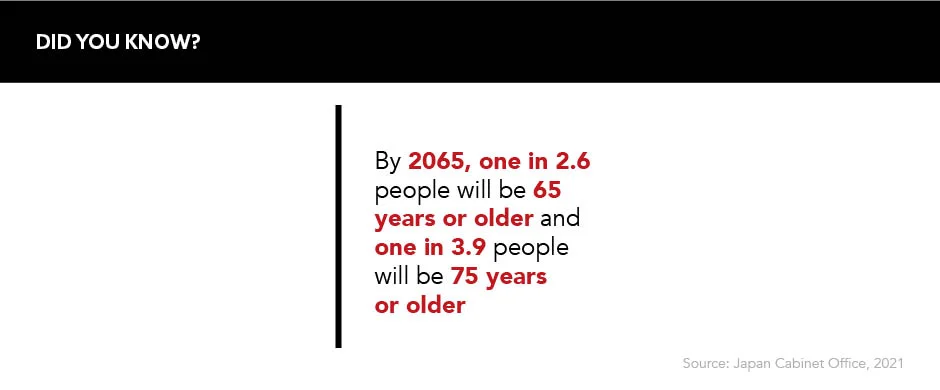

“Japan uses a lot of screening to define optimal treatment, where many markets in Europe are now only focused on cost lowering,” says Florent Edouard, Senior Vice President, Global Head of Commercial Evidence, Grünenthal Group. He also notes that the country’s ageing population sets the scene for “a perfect laboratory for elderly care management exploration, with a very well-developed network of small hospitals and practices delivering best-in-class care resulting in incredible life expectancy”. Those aged over 65 constituted 28.8% of the total population in 2020, rising from 27.7% in 2017, and the remarkable success in health improvement is projected to continue this upward trend to 38.4% by 2065.

Fragmented sales environment

While Japan offers a friendly landscape for patients, Lukowski argues the level of access to medicine can result in “fragmentation for pharma”, as it is faced with the challenge of covering a high number of institutions with an exceptionally large field force. Collating the data from this immense number of healthcare professional interactions can prove an arduous task and is something pharma companies should be wary of when approaching Japanese markets. In short, solid data management strategies are critical to ensure this process is optimised.

Engagement of local KOLs is critical, as well as local studies with Japanese patients

Edouard agrees, elaborating that “the market still heavily relies on the usage of in-person sales teams, despite some best-in-class digital practices” now being available to the market. In Japan, drug sales are still largely based on interpersonal relationships between sales reps and HCPs. “As the sales [reps] are very driven by personal relationships and tenure in the job, it is complicated to drive a performance agenda as well as introduce new marketing approaches,” he explains. “Engagement of local key opinion leaders (KOLs) is critical, as well as local studies with Japanese patients.”

To break into the Japanese market, hopeful companies must contextualise their data to the population and develop trust in new treatment options by forming strong local connections. “Without local studies and local KOLs, you can barely achieve reimbursement and approval will never be successful,” concludes Edouard. “This is more prevalent than in most other markets.”

Pricing policies

The drug market in Japan was valued at an estimated $105,689bn in 2019. Drug prices are high in the country – second only to the US – and this, alongside other favourable pricing policies, has made the nation a highly attractive market for international investment. For example, the government introduced the Price Maintenance Premium (PMP) in 2012, which adds a premium to a drug’s price if it is shown to treat an orphan or paediatric disease, in order to maintain international interest.

The PMP was designed to incentivise and reward further innovation in the country, but, as Cain Birkmose notes, there is a “growing concern for the stability of pricing policies emerging amongst pharmaceutical companies” in Japan, driven by, for example, “recent revisions to the PMP rule change, intermittent price revision and quarterly market expansion repricing”, she says.

This is clear in Japan’s Ministry of Health, Labour and Welfare biennial reviews of the system’s prices – on average lowering each cost by 5-7% every other year – and reviews are becoming annual for some high margin drugs. This clearly risks pharma companies looking to other countries to avoid this price fall.

That said, evolving attitudes are not restricting the industry and its goals exclusively. “The [new PMP] rules outlined that innovative drugs adding useful new indications would also benefit from the PMP as opposed to only applying to drugs at launch,” adds Cain Birkmose. Companies looking to gain success in the country may be wise to turn their attention to rare disease treatments as these are deemed the optimal therapies for driving the highest profit margins.

A push for generics

Another challenge in the Japanese pharma market is the substantially low rate of generic drugs available in the country. The industry has long been focused on getting patented, innovative treatments through to patients, however the allure of generic alternatives has proven strong over recent years. As previously mentioned, the cost of drugs in the nation is amongst the highest in the world, leaving ample room for generics to drive down the price of costly branded prescriptions. “Though the penetration of generics is increasing, this has not yet split the pharma market completely in two,” comments Edouard. The government had a volume share goal of 80% for generics by 2020 in a bid to reduce ever-rising healthcare costs, and as of 2021 this sat at 79%, up from 32.5% in 2005.

Though the penetration of generics is increasing, this has not yet split the pharma market completely in two

This progress was jeopardised in 2021 when key generics players had to cease drug production due to a series of Good Manufacturing Practice violations. Despite the Japanese government’s best efforts to reverse the deficit in generics manufacturing, 743 products became out of stock in September 2021. As of April 2022, 82 products were still out of stock. Japan remains in the midst of recovering from this, but local associations are having to work hard with watchdog schemes to recover the public’s trust in non-branded prescription medicines.

A new dawn

More improvements could be on the horizon for the Land of the Rising Sun. “The fact that health authorities mostly require clinical trials on their own population often delays and complicates processes for foreign products to enter the market,” according to Lukowski, who says this should be rectified. “For example, when Japan was developing COVID-19 shots, it experienced several months of delay because of this compared to other main markets,” he explains. While ensuring the data collected for new treatments is as applicable as possible to the country’s population, there may be better frameworks for clinical research to expedite access to new therapies.

Another potential market access win in Japan could be claimed through adopting alternative drug pricing models. The country could witness “emerging interest to create a European value-based approach to assess value”, Cain Birkmose states. “That is to say payers will cease to evaluate drug reimbursement based on traditional regulatory endpoints like regulatory and safety, and will evaluate medicines based on healthcare system, patient and societal value.” She believes this evolution will be watched with great interest, particularly from the international stage.

Japan is a success in isolation, but some, including Lukowski, believe the country should collaborate more with other players. “I wish to see more partnerships between local and foreign companies to exchange expertise and bring more differentiating drugs to the market,” he says. This, in turn, would improve pathways into the nation in addition to expanding Japan’s innovatory influence to other countries in need.