The Irish pharmaceutical sector is enticing more and more companies to its shores, but just what is driving companies to channel investment into the Emerald Isle?

Words by Jade Williams

Ireland has seen an influx of investment from the pharmaceutical industry of late. Astellas, which will invest more than €330m in a new facility in Tralee, County Kerry, is just the latest in a string of companies to announce plans to dip their toes in Irish waters.

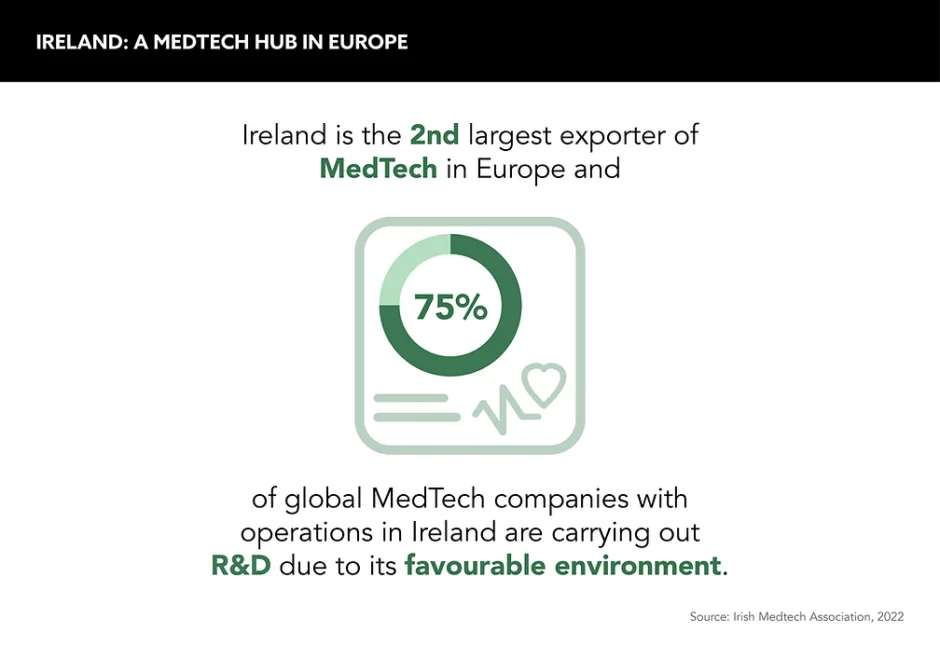

And with the country’s growing reputation for pharmaceutical innovation – who can blame them? Ireland was the third largest exporter of medicinal and pharma products in 2022, and it is fast establishing itself as a powerhouse in the life sciences and medical technology industries.

Aided by major investments from other pharma companies, such as AbbVie’s recent £23m facility in Dublin and MSD’s sites in Dublin, Cork, Carlow and Tipperary, the country is becoming an increasingly attractive place to call home for companies looking to expand their horizons. But just what are the reasons behind the country’s allure?

A landscape for innovation

One of the historic factors driving pharma to Ireland has been its comparatively low corporate income tax (CIT) rate. At just 12.5%, Ireland has one of the lowest corporate tax levels in the world. For example, Ireland’s rate is lower than that of a number of other global competitors, including Germany, which stands at 15.8%, the US at 21% and the UK at 25%.

This is, however, set to change next year as the Organisation for Economic Cooperation Development has announced plans to raise Ireland’s CIT to 15% in 2024 for companies with a turnover of over €750m. Nevertheless, the rate will remain comparatively low, and while the landscape is changing, it remains attractive, but not just for the sake of low CIT.

According to Yvette Murphy Skov, a strategic pharma consultant, there are other reasons for pharma to drop its anchor in Irish waters. “It’s the supply chain, the access to resources, the English language base while still being in Europe that pulls companies here,” she says.

Indeed, Ireland is ideally located for companies wishing to export their medicines to Europe, and after Brexit remains the only predominantly English-speaking manufacturing country in the EU. In addition, the country offers a generous 25% tax credit on qualifying R&D expenditure, meaning that some companies have more money left over for innovation.

More than a taxation haven

Aside from its enticing tax benefits, the jewel in Ireland’s crown is its abundant medical technology workforce, which is attracting more and more innovators of this kind to set up shop on its shores.

With a workforce of over 42,000 professionals, Ireland is Europe’s largest per capita employer of medical device professionals. The attractiveness of this workforce is underlined by an Astellas representative, who cites the country’s “highly educated workforce, with one of the highest science, technology, engineering and mathematics (STEM) enrolment rates in Europe” as another key factor in the company’s decision to invest in the country.

It’s a sentiment echoed by Skov, who argues that the country wouldn’t be so successful without its talent pool. “The government has put a lot of emphasis on promoting STEM subjects at school level over the last 15 years,” she comments.

In addition to all this, the country is the second-largest exporter of medical technology in Europe, exporting to 95 of the top 100 countries in terms of GDP. With exports worth a staggering €12.6bn, says the Irish MedTech Association, it is a global leader undoubtedly.

Troubled waters ahead?

Despite its status as the almost-home of MedTech, the sector in Ireland is facing significant challenges, particularly with the introduction of the European Medical Device Regulation (EU MDR) in 2021.

The EU MDR has forced some companies to slow down the production of their products as more time needs to be spent on safety precautions before products are shipped – delaying the supply chain and potentially creating delays for healthcare professionals and patients.

This issue was highlighted in a survey conducted by the European Society of Cardiology (ESC) in 2022, which found that 49% of clinicians who responded had experienced issues with the availability of medical devices since the MDR was enacted, and in 42% of these cases, the use of an alternate device was not as effective.

“The reported causes for unavailability included manufacturers withdrawing products due to the length and cost of MDR recertification and, in parallel, disruptions of supply chain and delivery issues,” ESC stated in a press release.

Ireland can shape the future of healthcare and take a greater share of the global market

A bold future

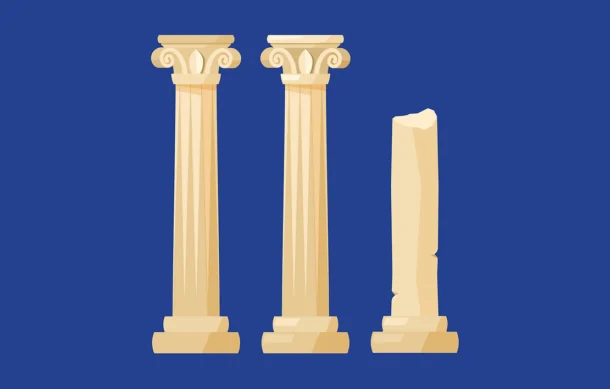

Despite the challenges facing its operations in medical technology, Ireland has charted an ambitious course for 2025. In a report by the Irish MedTech Association, titled ‘Dedication to the Expected, the Unexpected, and Everything In Between’, four strategic pillars have been identified that will enable the MedTech sector to continue to thrive and grow.

The report tells the country to focus on innovation with impact, attract the right talent to thrive, achieve excellence through collaboration and drive competitiveness. Off the back of these recommendations, Pat Duane, incoming Chair of the Irish MedTech Association, says: “Ireland can shape the future of healthcare and take a greater share of the global market.”

While challenges may be looming ahead for Ireland’s life sciences and medical technology sectors, the country’s future is bright: the MedTech market alone is forecasted to grow 5.6% (CAGR) annually with sales to reach €530bn by 2024.

“Ireland’s success story is so strong because it was made by design,” concludes Skov. “It didn’t happen by accident.” Between innovation, determination and strategic planning, Ireland is poised to continue playing a central role in the evolution of pharma worldwide.