Brazil has consistently appeared in the top 10 global pharmaceutical markets over the last decade and is making steady progress. GOLD journeys to the country’s sunny shores to examine its pharma landscape, its response to the COVID-19 pandemic and the prevalent wealth and access divides

Words by Jade Williams

Say the word Brazil and what comes to mind? Sun, sea and São Paulo. Or perhaps carnival, Caipirinhas and Christ the Redeemer. But how about pharma? As the largest country and healthcare market in Latin America, and sixth most populous country in the world, Brazil is a sought-after destination for the pharmaceutical industry, and for many reasons other than its spectacular landscape and vibrant culture.

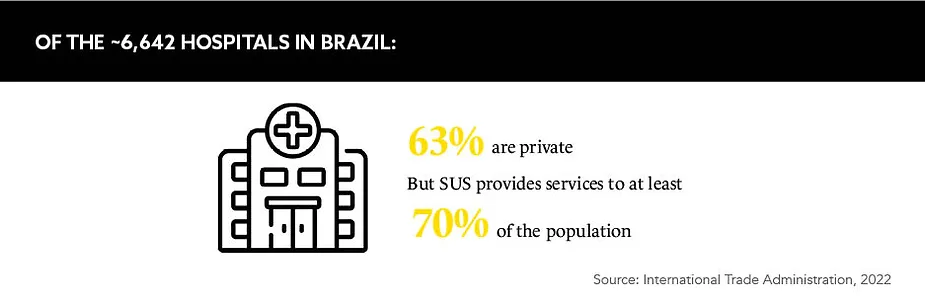

The country offers a rich market opportunity for international pharmaceutical companies brave enough to compete with local manufacturers and providers. Brazil utilises a Unified Healthcare System, known as SUS, which provides health services to at least 70% of its population. This public system provides free diagnostics, treatment and medication for some chronic diseases. And, according to the International Trade Administration, Brazil spends 9.1% of its GDP on healthcare.

However, the country is contending with an ageing population and stark wealth divisions. One quarter of Brazil’s population live in poverty, and over the past two decades the country has suffered repeatedly from Zika, dengue, chikungunya and other errant diseases that disproportionately affect the poorer population.

Claudia Martinez, Research Program Manager and Health Policy Lead, Access to Medicine Foundation, explains: “Even though Brazil has a system whereby there’s a free and universal public healthcare system, we do see that access to it is uneven across the country.”

With such a large reliance on SUS from a growing population, facilities are often oversubscribed, and waiting times can severely delay diagnosis and treatment. This is especially true in rural areas where there is a shortage of healthcare providers. Availability of, and access to, essential health products is not guaranteed for these underserved populations.

These challenges meant the country fell victim to the COVID-19 crisis harder than most. Despite the best efforts of the SUS, resources fuelling the response to the pandemic were insufficient. With over 30 million confirmed cases as of May 2022, Brazil sits as the second worst affected country by the pandemic after the US.

Existing access initiatives

While access issues prevail in Brazil, previous bids have been made to improve the landscape in the region. For example, on the cusp of the millennium, the Brazilian government passed the 1999 Generic Drug Act to reduce its overall expenditure on drugs and to lower the costs for patients, making treatment more accessible for all.

“The Generic Drug Act made it possible for more products to be seen in the market with affordable prices and was very important in the construction of the Brazilian healthcare system as it stands today,” notes Daniel Fonseca, Head of Marketing, Leo Pharma, Brazil.

Product development partnerships have also paved the way for more affordable pharma products in Brazil, and manufacturing capability initiatives have cemented the wider availability of drugs and devices for the nation. Larger international companies have also established a foothold in the country through outsourcing manufacturing facilities to Brazil, creating more jobs and a wider supply of vital medicines.

A new horizon for access

More recently, the pandemic improved another aspect of Brazil’s healthcare landscape: it increased access to digital health in the country. As patients were unable to meet with healthcare professionals face to face, digital systems were put in place to allow prescriptions to be fulfilled via an online consultation with a physician. Some people in remote areas who would not have the means to travel for health advice or a refill of antibiotics, for example, now have quicker and easier access to pharmaceutical products.

This has created a window of opportunity for the wider pharmaceutical industry to improve access to medicine in the region, which before has been widely catered to by local pharma companies such as Ache, EMS Pharma and Eurofarma.

The Generic Drug Act made it possible for more products to be seen in the market with affordable prices

Fonseca recommends that companies launching in Brazil first focus on the private healthcare sector to establish a basis for demand. Doing so “gives the physicians and, of course, the payers, a perspective of the acceptance and the results of this medicine in their own hands”, he says. Once a medicine is established as accepted, and benefits can be observed, the product can then be distributed on a wider basis through the public health system.

Martinez considers the introduction of new products to the region as beneficial, but reminds innovative companies that they “must build their portfolio to have widely necessary products for the country”, and ensure they have “available products that are actually reaching the underserved population”. Companies must go beyond stating their case for campaigns and “engage systematically in access issues”, she adds.

Forming the future

Looking to the future of Brazil’s access to medicine landscape, Martinez foresees sunny skies. “Over the next 10 years, I expect to see a stronger force behind local manufacturing, creating new opportunities for companies and patients providing and accessing treatment.” In light of this, companies looking to launch in Brazil must think about working proactively with local stakeholders as well as establishing education initiatives and campaigns to improve public health in the region.

And Fonseca notes: “There is still a huge need for attention in these areas, and government campaigns to educate the population to pursue treatment and improve lifestyles is the first answer to the problem.”

Brazil has come far in its efforts to level its healthcare imbalances, but companies operating on its shores will need to push beyond achieving commercial gains to establishing greater access to treatment and education for all.

Enjoyed reading about pharma in Brazil? Now travel to…