Biotechs have historically stood as agile hubs for drug discovery, but due to their size and tendency to fail, they have been considered risky targets by investors. The pandemic has changed outlooks and generated new interest in cell and gene therapies

Isabel O’Brien

The ‘biotech boom’ is a concept that not only rolls nicely off the tongue, but it is a rumbling force taking the pharmaceutical industry by storm.

The pandemic has created a noise around biotech that investors have found too deafening to ignore. So what has been the impact of COVID-19 on the sector, and can new momentum be sustained as the post-pandemic world approaches?

The biotech sector is largely comprised of cell and gene therapy firms specialising in the development of medicines that could prevent or cure some of the world’s most prevalent diseases such as Alzheimer’s and diabetes.

“The curative potential is immense,” says Jake Rubens, Co-Founder and Chief Innovation Officer, Tessera Therapeutics, at FT Live’s Global Pharmaceutical and Biotechnology Conference. “There is no other type of medicine that we’re aware of, besides maybe surgeries to fix a broken bone, where a patient can go to the hospital, have a procedure done and be cured for life.”

The curative potential is immense

There is no doubt surrounding the potential of these medicines to transform survival and quality of life outcomes for patients, but before the pandemic there were certain risks that discouraged investment. Biotechs were incredibly innovative and agile, but also had a tendency to fail.

Impact of the pandemic

Every explosion is ignited by a spark, and the success of Moderna’s mRNA COVID-19 vaccine has fueled the biotech boom the industry has witnessed.

During the pandemic, the company transformed from a small biotech, which was best known for a failed Zika virus vaccine, into a multi-billion-dollar company responsible for the most effective COVID-19 vaccine in existence. Looking at the specifics, Moderna’s Q2 2021 sales were up around 6,200% year-on-year, beating expectations by around $250m.

“We’re seeing renewed interest and more investment in these areas due to the mRNA vaccine race and just how transformative that was,” says Gabriel Cavazos, Senior Managing Director, Biotechnology, SVB Leerink, also at FT Live’s conference.

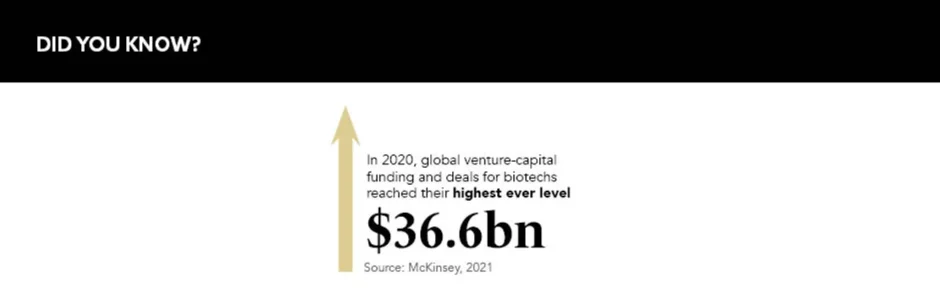

One notable shift in investment patterns has been the emergence of generalist investors, particularly from the technology sector, who have been injecting funds into biotech firms working on innovative medicines for all kinds of diseases. “Generalists were pouring into the sector, and 2020 was a record year by any measure in terms of deal-making, deal flow and dollars invested,” says Rubens.

Biotech companies have responded effectively to this increased interest and have easily adapted to the virtual listing process. While IPO launches in person would have taken seven to ten days, companies managed to reduce the time to just three days. This is further evidence, if any were needed, that companies were able to navigate the challenging circumstances of the pandemic and capitalise on the surge in interest from outside the industry.

Maintaining momentum

Emphasising the importance of keeping the boom of biotech alive, Nicole Gaudelli, Director and Head of Gene Editing Technologies, Beam Therapeutics, also tells FT Live conference delegates: “As carriers of this torch of this new era of genetic medicines and beyond, it’s really our responsibility to make sure that we are able to share the technology and get it to as many patients as possible.”

While direct investment is important, Gaudelli stresses that biotechs must partner with rival companies to ensure widespread access to their creations. “There are so many different places you could go, or diseases that you can treat, you can’t possibly have the expertise to do every one thing,” she says. By licensing elements of their technology, firms can reap additional funds while also allowing other companies to innovate in areas where a particular biotech may lack prowess.

2020 was a record year by any measure in terms of deal-making, deal flow and dollars invested

Gaudelli caveats this point by asserting that biotechs must remain as independent as possible if they are to pioneer the next generation of game-changing genetic therapeutics. “I don’t see us going away anytime soon or being engulfed by larger organisations,” she says. While many firms are now aspiring to become multi-billion-dollar corporations like Moderna, it is important for biotechs to retain the subtleties that position them as agile and unique.

The pandemic has propelled the interest of investors towards genetic medicines, creating a racket for biotechs who are enjoying being the subject of the chorus. While the presence of generalist investors is typically fleeting, the success of Moderna has shown what is possible if financiers are prepared to take a gamble.

“It’s in our DNA – with no pun intended – to try often and fail often, but the successes are life changing, even world changing,” concludes Cavazos. Investing in biotechs may be risky, but the triumphs can be life-changingly impactful.